Stocks, stocks, stocks: top executives are being showered with them

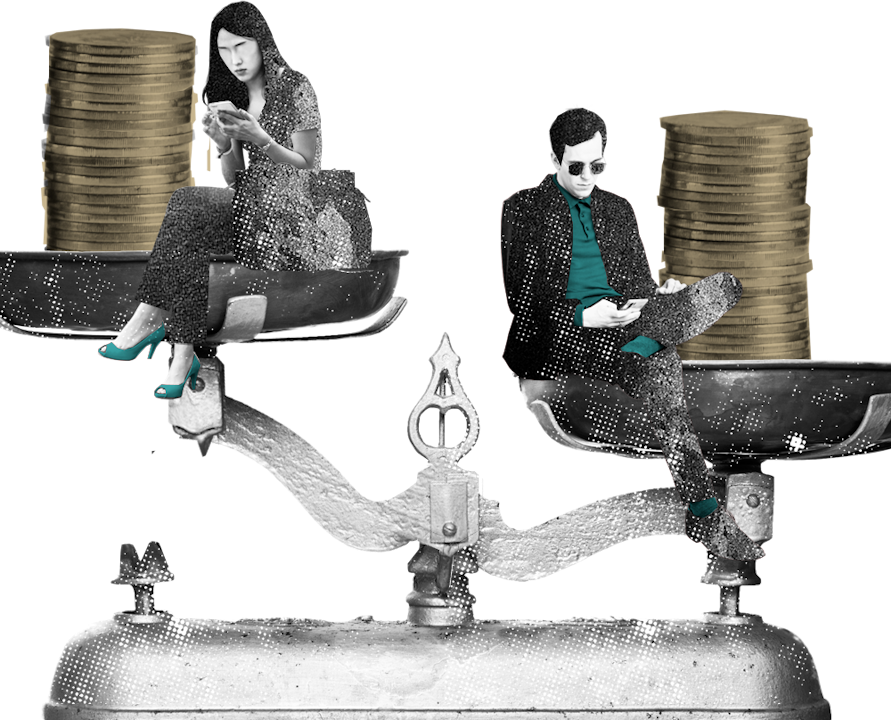

Illustration: Luis García for FD

Terri Kelly is doing her best. As a member of the ASML board responsible for remuneration policy, it is up to her to explain at the shareholders' meeting this spring why the maximum long-term bonus for new directors should be increased from 400% to 450% of the base salary. The company must have that leeway to attract or retain top talent, Kelly argues. The intention is to actually use it in 'critical situations' only.

Chairman Nils Andersen also puts his two cents in. According to him, the Netherlands is not generous with its top salaries and he sees it as his task to prevent talent from leaving the chip machine manufacturer from Veldhoven. Does the audience know that the maximum long-term bonus at American companies is on average 500%, the Dane wonders out loud.

Long-term bonus keeps increasingASML is no exception with its bonus policy. A growing number of companies in the AEX index are further increasing the long-term bonus for their highest executive. At maximum performance, CEOs can receive an average of 342% of their base salary in shares. In 2014, this was still 282%.

Especially tech companies Besi, ASM and ASML, exotics like UMG and Exor, and British companies like Shell and Relx are pulling the wallet. The maximum share bonus for these companies varies from 400% to (in the case of ASM) 900%. Investment company Exor is requesting approval this year for a bonus maximum of 1200%.

This is evident from the annual remuneration survey that the FD conducted with the help of consultancy firm PwC among the 25 largest listed companies. The interest group for institutional investors Eumedion sees the trend mainly among listed companies that are very active in the US, such as Ahold Delhaize, Randstad and Wolters Kluwer. 'These companies more or less automatically import part of the American remuneration practice', says director Rients Abma.

Skin in the gameThe long-term bonus in shares is further increased, but the annual bonus, the short-term bonus, is also increasingly paid partly in shares. For a long time, it was paid entirely in cash. The long-term bonus is paid entirely in shares, but that only happens after three years.

Anglo-Saxon shareholders find this too long, especially since in the United Kingdom a CEO is in office for an average of 5.2 years, according to headhunter Spencer Stuart, and in the United States for 7.5 years. No recent data is available for the Netherlands. These shareholders want CEOs to have 'skin in the game' as soon as possible, or the same interest as the shareholders. KPN, Besi and ING are examples. AkzoNobel requires its directors to invest 25% to 50% of their annual bonus in shares of the paint manufacturer.

Abma of Eumedion says that partly converting the cash bonus contributes to a long-term view of the CEO. 'Of course, on condition that a director must hold the shares for a longer period.' The code for good corporate governance recommends a term of at least five years.

Undesirable behaviorMany companies are tightening the requirement for how many shares the top executive must hold. At Randstad, the lower limit for the CEO has been raised from one and a half times the annual salary to two times, at ASML it has been raised from three times to four times the basic salary. According to Abma, it is a trade-off: the maximum bonus may increase, but then executives must hold their shares and not cash them in immediately.

But there are also disadvantages to large share packages: they can encourage undesirable behavior. Annet Aris, commissioner at various companies, points to research from the University of Waterloo (Canada) which shows that a CEO will exhibit risk-averse behavior if he has a lot of shares. Riskier projects such as takeovers or high investments in research and development are avoided. 'Suboptimal trading', Aris calls that.

Another dilemma arises when a director sells his shares. There is often a social uproar when a CEO cashes in part of his share package and then heads the ranking of high earners with an income of millions.

Highest paid at €17.1 millionASML may be increasing its pay, but the salary of a future CEO is still dwarfed by that of other top earners on the Damrak. Richard Blickman, the person ultimately responsible at chip company Besi, took the crown in 2024 with €17.1 million. He has a relatively low basic salary of €700,000, but benefits from the high global demand for chips that drives Besi's stock price, and thus the value of his share package. Blickman dethrones departing CEO Nancy McKinstry of publisher Wolters Kluwer.

Second is Erik Engström of the British publisher Relx. His total income for 2024 was €15.7 million. McKinstry came in third with €12.2 million. At the bottom of the ranking are the directors of ABN Amro and Adyen. This is because since the financial crisis of 2008, banks are allowed to pay a maximum variable bonus of 20% of the basic salary. Adyen is allowed to do so, but does not – the directors already own a lot of shares.

The average total income for the CEOs of the 25 largest listed companies is €4.8 million excluding pension contributions. This is an increase of 4% compared to 2023. The financial director earns an average of €2 million less, even though the CFO is, as statutory director, partly responsible and partly liable for the policy pursued.

Foreign companies listed on the Amsterdam stock exchange, such as Exor, Prosus, UMG and ArcelorMittal, were not included in the study. Companies with a foreign passport but Dutch roots, such as Shell, Unilever, Relx, Aegon and DSM-Firmenich, were included.

The 'exotics' have a more Anglo-Saxon remuneration policy. The remuneration of their CEOs is considerably higher than the average of the AEX funds. Last year, CEO Lucian Grainge of music company UMG received €37.1 million. That is twice as much as the top earner of the 'Dutch' AEX funds. The now retired CEO Bob van Dijk of Prosus also surpassed top earner Blickman.

The €1 million reward for John Elkann of Exor seems moderate, but that is because the investment company is still young. Elkann was awarded conditional shares worth more than €10 million last year. Depending on his long-term performance, he will receive them later.

At ArcelorMittal, the remuneration for the top is the lowest compared to the other 'exotics', but there CEO Aditya Mittal is the son of billionaire and major shareholder Lakshmi Mittal.

Want to know more about rewards? Read the stories below from April 2022, in which we explain exactly how rewards are built up, why they have increased in recent years and how politics and business are trying to limit top salaries.

fd.nl

%2Fhttps%3A%2F%2Fcontent.production.cdn.art19.com%2Fimages%2F86%2Fac%2F70%2F1e%2F86ac701e-5fdd-4be7-82c3-7c0f901ed53a%2Fec7f2dacab93d83d800e9a8bfdb399110698cf09e6b1ae01b88b50fdd843b2a3192fd324f758a7547594bc50dfdd01df08496e679f8f80627803736c84e6432c.jpeg&w=3840&q=100)

%2Fs3%2Fstatic.nrc.nl%2Fimages%2Fgn4%2Fstripped%2Fdata131837219-a4351a.jpg&w=3840&q=100)

%3Aformat(jpeg)%3Afill(f8f8f8%2Ctrue)%2Fs3%2Fnrctest.static%2Ftaxonomy%2Fe70939d-youp-portrait%252520%2525281%252529.png&w=3840&q=100)

%2Fs3%2Fstatic.nrc.nl%2Fimages%2Fgn4%2Fstripped%2Fdata131495621-6ae4ac.jpg&w=3840&q=100)