Poland cuts interest rates for first time since 2023 citing weaker economy activity and slowing inflation

Poland's central bank has cut its benchmark interest rate for the first time since October 2023, citing slowing inflation and weakening economic activity as grounds for easing monetary policy.

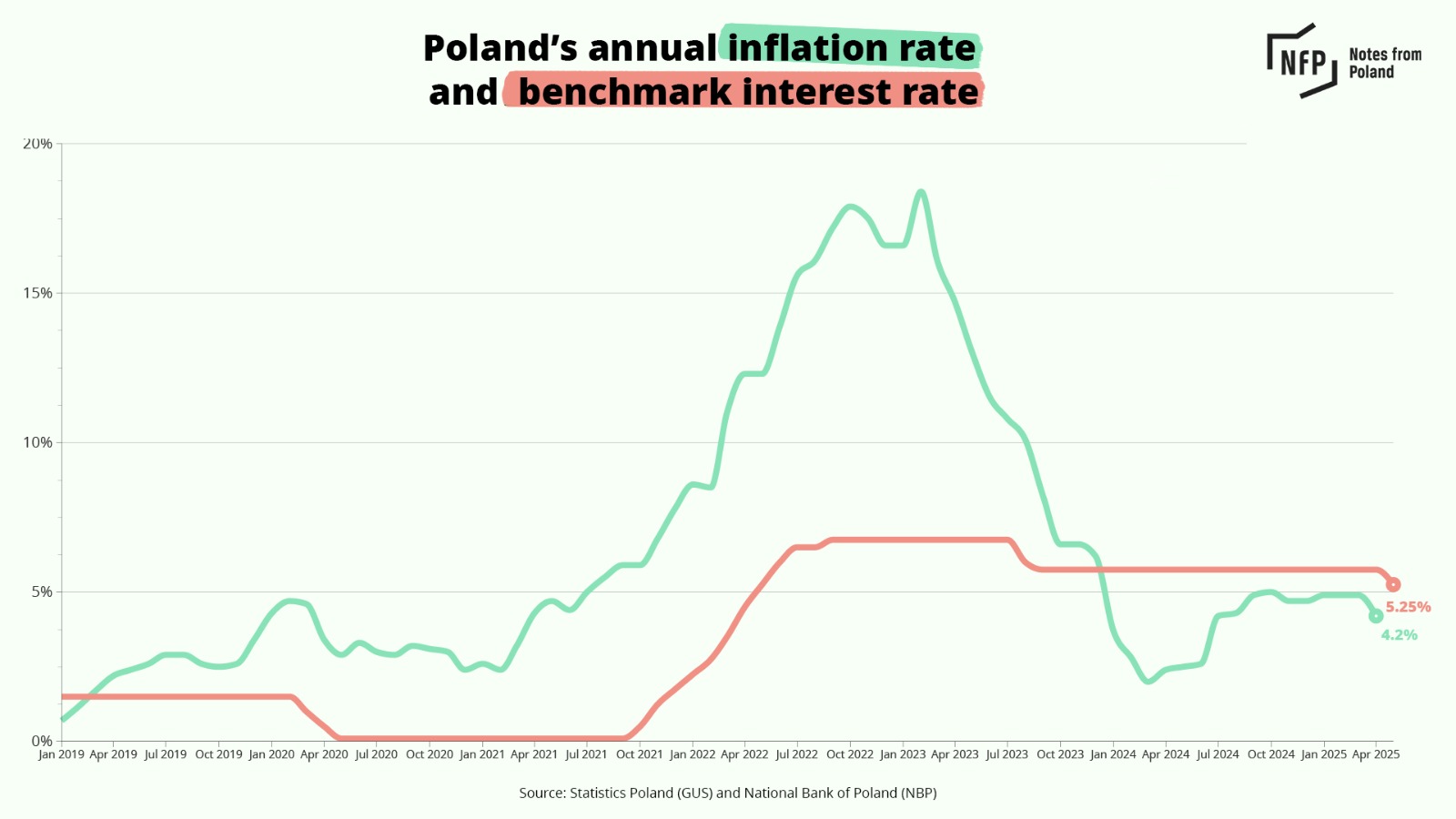

The National Bank of Poland (NBP) lowered its reference rate by 50 basis points to 5.25%, in line with market expectations. The market is unsure about possible further moves by the NBP's Monetary Policy Council (RPP), however. Some expect the next 50-basis-point cut as early as next month.

“Taking into account incoming information, including current lower and forecast inflation, decreasing wage growth and weaker data on economic activity, in the council's assessment, the adjustment of the level of the NBP interest rates became justified,” the MPC said in a statement following its rate-setting meeting.

Wage growth has slowed notably, with average monthly salaries in the corporate sector increasing by 7.7% year-on-year in March. That marked the fourth straight month of annual wage growth below 10%, a significant drop from the nearly 16% rise recorded in July 2022 at the height of post-pandemic inflationary pressures.

A flash estimate from Poland's statistical office, Statistics Poland (GUS), also indicates a slowdown in inflation, which stood at an annual 4.2% in April, down from 4.9% in March, according to the consumer price index (CPI). The central bank's inflation target is 2.5%, with an allowable deviation of plus or minus one percentage point.

The NBP attributed the April slowdown to the fading impact of the high base effect of last year's sharp rise in food prices, driven in part by the reinstatement of the standard VAT rate on food in April 2024. It also pointed to lower fuel prices, attributing the drop to falling global oil prices and a weaker US dollar.

Looking ahead, economists remain divided on the pace of further monetary easing. Some expect the NBP to hold rates steady at its June meeting before resuming cuts later in the year, while others anticipate another 50-basis-point reduction as early as next month.

“The council will likely wait for the July inflation and GDP projection before deciding on the next step,” Adam Antoniak, senior economist at ING BSK, a bank, told the Interia news website ahead of Wednesday's announcement.

But Kamil Łuczkowski, an economist at Pekao bank, told the website that, “as far as the next months are concerned, we forecast – in line with what [NBP] President [Adam] Glapiński said – that there will be a dynamic adjustment of interest rates. Therefore, we also assume a 50 basis point cut for June.”

The new US tariffs announced by President Trump could lower Poland's GDP by around 0.4%, amounting to over 10bn zlotys (€2.4bn), says @donaldtusk .

"A severe and unpleasant blow, because it comes from our closest ally, but we will survive it," he adds https://t.co/VPu5CKQGPU

— Notes from Poland 🇵🇱 (@notesfrompoland) April 3, 2025

He added, however, that the MPC is likely to pause afterwards to assess the impact of its decisions, entering a “wait and see” phase. “If disinflationary trends continue, the council may resume rate cuts in the second half of the year,” he said.

The post-meeting statement offered little clarity on the likely path of monetary policy, with ING analysts noting the absence of any explicit forward guidance, stating only that future decisions would depend on incoming data.

Experts at PKO BP, another bank, meanwhile, believe that the MPC will deliver two more smaller cuts this year. “In our view, the benchmark rate will be 4.75% at the end of 2025. Next year, we expect cuts of another 100bp, ultimately to 3.75%,” they wrote on X.

The Council described today's cut as an ADJUSTMENT, which suggests that at this stage it does not want to announce further cuts (and the cycle). Despite this, we think that the MPC will continue to cut rates towards their neutral level. We assume that the next moves will be standard… pic.twitter.com/6oOBkBNP9A

— PKO Research (@PKO_Research) May 7, 2025

Main image credit: Lukasz Radziejewski / Pexels

notesfrompoland